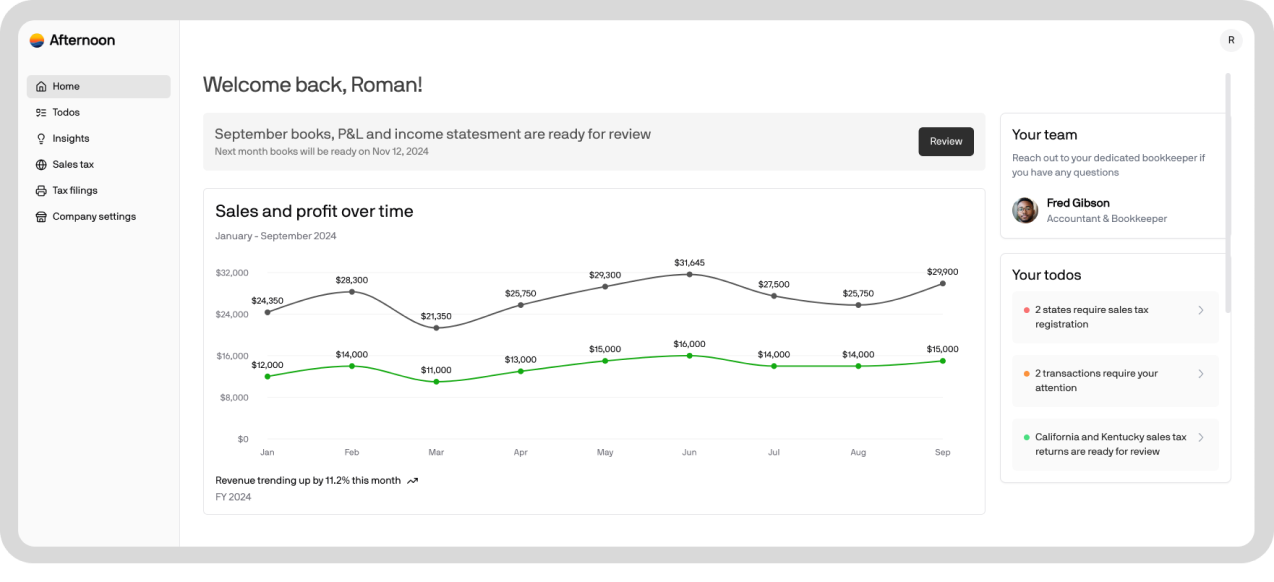

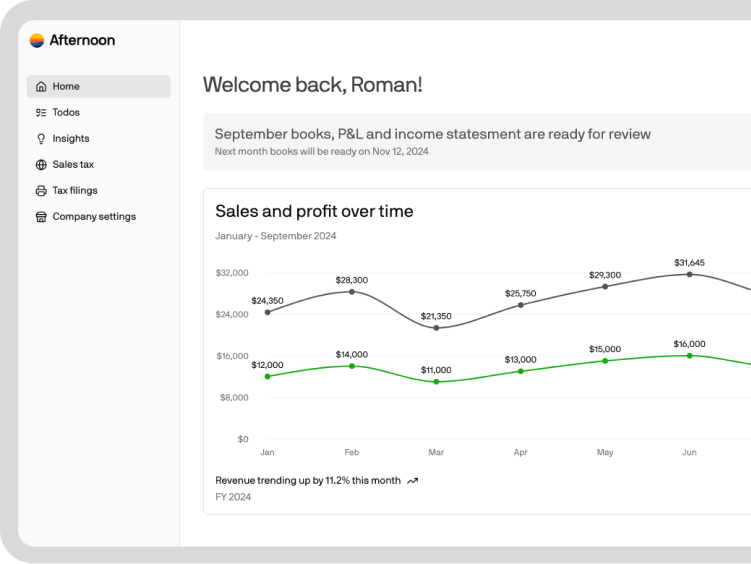

All-in-one bookkeeping and tax platform for ecommerce brands

Focus on growing your business, while Afternoon takes care of your bookkeeping, income and sales taxes.

We help you save time and avoid penalties

Bookkeeping

If you don't have a bookkeeper or accountant, we can help you keep your books clean and up to date.

Bookkeeping services

Monthly financial statements

Expense tracking

Invoicing and payments

Year end and quarterly taxes keeping

If you don't work with CPA we can help you file your year end and quarterly taxes.

Year-end tax filing

Quarterly estimated tax calculations

Tax deduction optimization

Audit support

Sales tax automation

Calculate, file, and remit sales tax in all US states automatically.

Nexus monitoring

Support for all 50 US States

Annual, quarterly or monthly filings

Audit support

Government compliance + mail

Automate goverment communication and filings.

Compliance calendar with all key dates

LLC Renewals

Annual reports with states

No more missed snail mail

If you don't have a bookkeeper or accountant, we can help you keep your books clean and up to date.

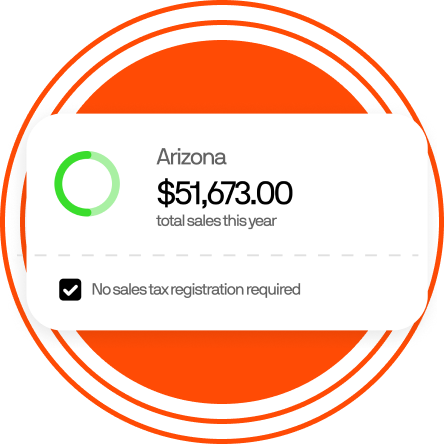

Effortless sales tax compliance

Afternoon makes it easy to monitor exposure, register, and file sales tax in all US states.

Monitor exposure

Connect your billing and HR system to monitor your exposure in real-time.

Nexus study

Our tax experts will determine which states you have a tax obligation in, and which states you need to register in.

Register

Register in any US state with a single click. Afternoon will registrer you in all states where you have a tax obligation.

File and remit sales tax automatically

We will file and remit sales taxes in all states automatically on your behalf.

Frequently Asked Questions

What would you like to know about Afternoon?

What is Afternoon?

What kind of companies do Afternoon serve?

Does Afternoon handle bookkeeping?

Does Afternoon handle my business income taxes?

Why should I care about sales tax?

Which states do I need to register to collect sales tax in?

Will Afternoon help me with registrations?

Ready to get started?

Focus on growing your business, while Afternoon takes care of your bookkeeping, income and sales taxes.

Get Early Access